Boldly operating wherever the world's demand creates opportunity.

Boldly operating wherever the world's demand creates opportunity.

Boldly operating wherever the world's demand creates opportunity

Why we started

Why we started

Turn on focus mode

Indonesia's economy is growing as a result of legislative backing of future-forward initiatives

Indonesia's economy is growing as a result of legislative backing of future-forward initiatives

Turn off focus mode

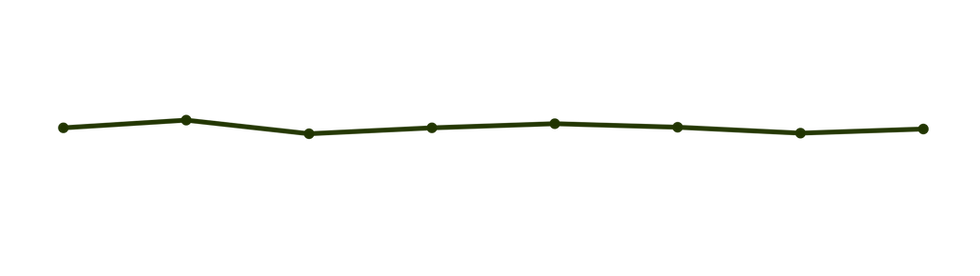

2023 Q1

2023 Q2

2023 Q3

2023 Q4

2024 Q1

2024 Q2

2024 Q3

2024 Q4

5,04%

5.17%

4.94%

5,05%

5.1%

5.05%

4.95%

5.02%

2023 Q1

5.17%

2023 Q2

2023 Q3

5,05%

2023 Q4

5.1%

2024 Q1

5.05%

2024 Q2

4.95%

2024 Q3

5.02%

2024 Q4

5,04%

4.94%

Rate of growth predicted for the year 2025: 5.5%

The mining sector comprised 12.22% of the nation's gross domestic product (GDP) in 2022.

of the global mined Nickel production in 2023 came from Indonesia

54%

60%

Indonesia's predicted share of global mined nickel supply

5,04%

5.17%

4.94%

5.05%

5.1%

5.05%

4.95%

4.02%

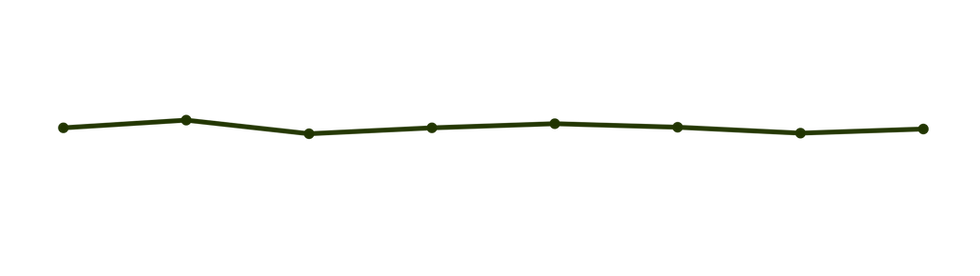

'23 Q1

'23 Q2

'23 Q3

'23 Q4

'24 Q1

'24 Q2

'24 Q3

'24 Q4

Turn on focus mode

Turn off focus mode

Why we started

The mining sector comprised 12.22% of the nation's gross domestic product (GDP) in 2022.

of the global mined nickel production in 2023 came from Indonesia

Indonesia's predicted share of global mined nickel supply

54%

60%

The mining sector comprised 12.22% of the nation's gross domestic product (GDP) in 2022.

Indonesia's economy is growing as a result of legislative backing of future-forward initiatives

4.02%

'24 Q4

''24 Q3

4.95%

'24 Q2

5.05%

'24 Q1

5.1%

Rate of growth predicted for 2025: 5.5%

5,04%

'23 Q1

'23 Q2

'23 Q3

'23 Q4

'24 Q1

'24 Q2

'24 Q3

'24 Q4

4.02%

4.95%

5.05%

5.1%

5.05%

4.94%

5.17%

Source: Institute for Development of Economics and Finance

Source: Institute for Development of Economics and Finance

The mining sector comprised 12.22% of the nation's gross domestic product (GDP) in 2022.

54%

60%

of the global mined Nickel production in 2023 came from Indonesia

Indonesia's predicted share of global mined nickel supply

Our takeaway

Our value to the supply chain can be as simple as streamlining from pit to port.

Topsoil stripping

Overburden removal

Land clearing

Ore excavation

Loading and hauling

McKinsey estimates that supply chain inefficiencies cost mining operations 15–20% of annual revenue, mostly due to siloed loading, logistics, and storage processes.

A streamlined pit-to-port model can reduce lead times, cut waste, and boost production.

1.8*

0.1

1.0

1.4

* in billion tonnes

Source: Geological Branch, Ministry of

Energy and Mineral Resources 2018

Nickel is core to electric vehicles and grid batteries. Yet supply chains are brittle. People find shortcuts to get in on the action but don't know the material intimately to handle it responsibly.

Nickel is a resource to facilitate the future, but it needs careful management.

Nickel needed in BEV batteries jumped 8% year on year to average 25.3 kilograms per battery.

Indonesia accounts for 51% of the world's nickel mine production. Yet, supply chains are brittle.

billion tonnes

1.4

billion tonnes

1.0

billion tonnes

1.8

billion tonnes

0.1

Our value to the supply chain is streamlining from pit to port.

Our takeaways

McKinsey estimates that supply chain inefficiencies cost mining operations 15–20% of annual revenue, mostly due to siloed loading, logistics, and storage processes.

A streamlined pit-to-port model can reduce lead times, cut waste, and boost production.

Land clearing

Top soil stripping

Overburden removal

Ore excavation

Loading and hauling

Nickel is a resource to facilitate the future, but it needs careful management.

0.1

1.0

1.8*

Nickel needed in BEV batteries jumped 8% year on year to average 25.3 kilograms per battery.

*in billion tonnes

Nickel is core to electric vehicles and grid batteries. Yet supply chains are brittle. People find shortcuts to get in on the action but don't know the material intimately to handle it responsibly.

1.4

Indonesia accounts for 51% of the world's nickel mine production yet supply chains remain brittle.

Regulatory risk

Collaborate with legal compliance team

Permit delays

Special permit and relations taskforce

Unclear exploration targets

Inefficient transport

Simulate route optimization

Manual reporting

Centralized data warehouse/ ERP

Poor coordination

Get solutions

Overlapping interests

Early due diligence pre-acquisition

Integrated scheduling dashboard

community insights to narrow down

Overlapping interest

Poor coordination

Inefficient transport

Regulatory risk

Permit delays

Unclear exploration targets

Get solutions

Early due diligence pre-acquisition

collaborate with legal compliance team

special permit and relations taskforce

Poor coordination

Simulate route optimization routinely

community insider insights to find constraints

The industry is riddled with unnecessary complications that need disruption.

Manual workflows, fragmented ownership, and excessive paperwork add 10–30% overhead to operations, according to Deloitte. These inefficiencies stall decision-making, inflate costs, and diminish competitiveness.

Get solutions

You lay the groundwork, we'll execute with flying colors

Nickel ore mining and production

Land clearing and disposal

Nickel ore transport

Lab preparatory research

Nickel ore trading

Jetty establishment

Site survey and exploration

Hauling route creation

Hauling route implementation

Licensing

You lay the groundwork, we execute with flying colors

Our round of personnel has 32+ years of hands-on experience managing complex processes and quality control.

Our services

.png)